Cross-border payments are the adult version of passing notes in class, except the teacher is a bank, the note goes missing for three days, and everyone takes a fee for the privilege. If you work in Web3, you have probably watched a business send money from one country to another and lose time, money, and patience, even before anyone mentions foreign exchange.

DeFi can reduce that mess because it can move value as stablecoins, route it through on-chain liquidity, and settle fast. However, “no FX fees” is not a magic spell. You still have spreads, on- and off-ramps, and compliance steps, so the real question is how to automate the flow so the user gets a clear price and a clean receipt.

Quick Answers – Jump to Section

- What people mean by “no FX fees”

- The basic flow: stablecoin in, stablecoin out

- Where DeFi automation starts: routing and settlement

- The question everyone asks: “Is the rate better than Wise?”

- “What about compliance?” is not a boring question

- Automation with invoices: “Can I send an invoice that pays itself?”

- Escrow and milestones: fewer arguments, cleaner delivery

- Bridges, chains, and the “wrong network” problem

- Liquidity is the quiet boss of cross-border payments

- “Can I pay in local currency at the other end?”

- What to build if you work in Web3 payments

- Frequently Asked Questions

- Final thoughts

What people mean by “no FX fees”

When people say “no FX fees,” they normally mean “no bank markup and no surprise charges.” They are tired of paying a bad rate, then paying a wire fee, then paying an extra fee they only notice when the money arrives short. In DeFi, you can avoid the bank’s FX desk by moving a stablecoin that already sits in a single unit, like dollars on-chain.

Still, you do not get a free lunch. The cost moves into other places, like swap spread, bridge costs, gas, and the ramp that turns stablecoins into local cash. So the honest promise is not “zero cost,” it is “clear cost that you can measure and often reduce,” which is what businesses want.

1) The basic flow: stablecoin in, stablecoin out

A lot of questions boil down to: “Can I just pay someone overseas in USDC and call it a day?” Sometimes, yes. If both sides can hold stablecoins, the simplest flow is stablecoin in, stablecoin out, with no conversion step in the middle.

For Web3 teams, the job is to make that feel like normal payments. The sender needs an invoice amount, a due date, and a single address or payment link, and the receiver needs a way to confirm funds arrived. If you already deal with global contractors, the thinking in Global Hiring Made Simple for Web3 Startups pairs well here because it keeps the “how do we pay people abroad?” story grounded.

2) Where DeFi automation starts: routing and settlement

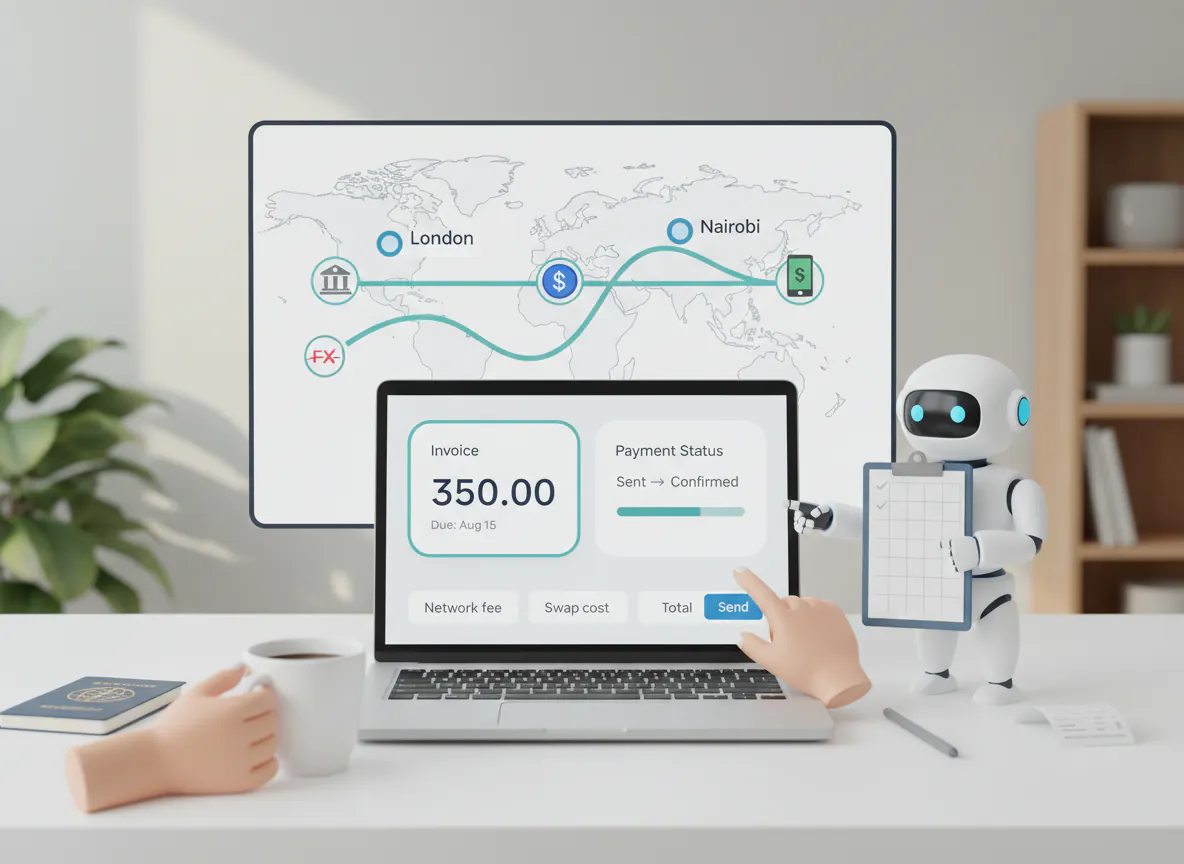

People often ask, “What part is DeFi doing here, and what part is just crypto?” DeFi matters when you want routing, pricing, and settlement to happen without a human copying numbers between apps. For example, a protocol can swap one stablecoin to another, pick the best pool, and settle in seconds, then your app can show the user one final amount.

That is where automation becomes real. Instead of a finance person checking rates and sending wires, you can build a flow that quotes a price, locks it for a short time, and completes the payment when the user confirms. In other words, the protocol does the boring plumbing, while your product handles the human steps.

3) The question everyone asks: “Is the rate better than Wise?”

This one shows up constantly: “Is DeFi cheaper than Wise, Revolut, or a bank transfer?” The answer depends on the corridor, the amount, and the ramps. For some routes, DeFi can be cheaper because liquidity is deep and stablecoin rails are fast. For other routes, the ramp fees and local cash-out costs can eat the savings.

So the right way to talk about it is with a simple cost breakdown. Show the user the swap spread, the network fee, and the ramp fee, then compare it to the bank’s total cost. If you cannot explain the cost in plain language, you will not win confidence from a finance lead who has been burned before.

4) “What about compliance?” is not a boring question

On forum threads, people keep asking, “Is this legal?” or “Will my bank freeze me?” That is not paranoia, it is lived experience. Cross-border payments touch sanctions, fraud checks, and reporting rules, and stablecoins do not remove that.

For Web3 teams, the practical move is to treat compliance as part of the product, not a footnote. Build clear checks, keep records, and make it obvious what the user is allowed to do. If your product hides the rules, users will still hit the rules, just at the worst moment.

5) Automation with invoices: “Can I send an invoice that pays itself?”

This is a popular question because it sounds like a dream: “Can I automate invoices so the payment happens on schedule?” You can get close. You can create invoices with payment links, reminders, and even on-chain escrow that releases funds when conditions are met.

However, the real world still has humans. Clients dispute invoices, change amounts, and pay late, so your system needs a way to pause, edit, and confirm. Automation should remove repeated admin, not remove control, because finance teams do not enjoy surprises.

6) Escrow and milestones: fewer arguments, cleaner delivery

People ask, “Can DeFi stop payment disputes?” It can reduce them when you use escrow and milestones. For example, funds can sit in a contract, then release when both sides confirm a deliverable, or when a clear deadline passes.

This is useful for cross-border work because disputes are harder when the parties are in different countries and legal routes are slow. Still, you need simple terms, simple buttons, and a clear support path, because a contract that nobody understands is just a new way to argue.

7) Bridges, chains, and the “wrong network” problem

A very common fear is, “What if I send it to the wrong chain?” That fear is valid. Cross-chain payments add more steps, and every step is a chance for a user to make a mistake.

Therefore, good products hide complexity. They pick the chain, show one payment option, and warn users before they do something permanent. If you cannot make the flow safe for a tired founder paying invoices at midnight, you are not ready for real payments.

8) Liquidity is the quiet boss of cross-border payments

Another question that comes up is, “What happens if there is no liquidity?” If a pool is thin, the spread gets worse, and the user pays more than expected. That is not a bug, it is how markets work.

So if you are building in this space, you need to monitor liquidity by corridor, set limits, and show clear quotes, and the logic behind How to Win the Money Future Battle: Stablecoins vs Banks helps frame why stablecoin rails can beat bank rails on speed and transparency.

9) “Can I pay in local currency at the other end?”

This is the business-friendly version of the problem: “My supplier wants pesos, not USDC.” To do that, you need a ramp or a partner that can convert stablecoins to local cash and deliver it to a bank account or mobile wallet.

DeFi can still help because it can handle the on-chain part and give you fast settlement, but the last mile is usually off-chain. That is fine. The product win is making the whole flow feel like one payment, with one receipt, and one clear cost.

10) What to build if you work in Web3 payments

People ask, “What should I build first?” Build the boring screens. Build the quote screen that shows total cost. Build the invoice screen that shows status. Build the receipt screen that a bookkeeper can understand.

Then, write content that answers the same questions your users ask in chat: cost, speed, safety, refunds, and what happens when something goes wrong, and if you want a clean way to explain programmable flows to non-technical people, How to Fix Supply Chain Finance Using Programmable Money gives you language that stays practical.

Frequently Asked Questions

Do DeFi cross-border payments really avoid FX fees?

They can avoid bank FX markups by moving stablecoins, but you still pay other costs like swap spread, gas, and ramp fees. The win is often clearer pricing and faster settlement.

Is DeFi cheaper than Wise for international payments?

Sometimes. It depends on the corridor, the amount, and the ramps. The only honest way is to compare total cost side by side.

What is the biggest risk in automated cross-border payments?

User mistakes and unclear pricing. Wrong networks, wrong addresses, and hidden fees can turn a fast payment into a support nightmare.

Can I automate invoices using DeFi?

You can automate reminders, payment links, and escrow flows, but you still need human controls for disputes, edits, and approvals.

How do I explain this to a non-crypto finance lead?

Start with the business problem: time, fees, and uncertainty. Then show a simple cost breakdown and a clear receipt they can file.

Final thoughts

DeFi can automate cross-border payments by turning money into stablecoins, routing it through liquidity, and settling fast, which can reduce bank FX markups and remove a lot of manual admin. However, the promise only holds if you make the costs clear and the flow safe, because payments are where small mistakes become big problems.

If you work in Web3, your advantage is not the tech, it is clarity. Build the product so a 10-year-old could follow the steps, then write the content so a busy finance lead can check the numbers, and you will have something that survives outside crypto Twitter. The structure in How to Build a Multichannel Marketing Strategy for Web3 Businesses is a good reminder that distribution and education still matter even when the payment rail is better.

_________________________________________________________________

Download your free copy of the Growth Engine Blueprint here and start accelerating your leads today.

Want to know how we can guarantee a mighty boost to your traffic, rank, reputation and authority in you niche?

Tap here to chat to me and I’ll show you how we make it happen.

If you’ve enjoyed reading today’s blog, please share our blog link below.

Do you have a blog on business and marketing that you’d like to share on influxjuice.com/blog? Contact me at rob@influxjuice.com.

Latest Blogs

- Powerful Ways Miro Helps Smart Businesses Achieve Faster, Smarter Results

- 8 Proof Signals That Make DeFi Users Feel Safe

- How Trainual Transforms Onboarding into a Simple, Profitable Growth Engine

- 7 Community Growth Approaches Ranked by ROI for Web3 Startups

- 5 Token Launch Strategies Compared: Costs, Risks, Results

Leave a Reply

You must be logged in to post a comment.