Global hiring and running a worldwide team in the web3 space comes with unique payment challenges. From paying developers in different countries to handling crypto salaries, traditional payroll systems fall short. Before you give up on your Web3 startup before it’s begun, there’s now a solution… and it’s called Rise.

Rise is one of our clients and has built a comprehensive solution that handles both traditional and crypto payments across 190+ countries.

The Global Workforce Problem

Web3 companies face specific hurdles when building international teams. Contractors spread across multiple jurisdictions create compliance nightmares. Traditional banks resist crypto transactions. Remote employees want flexible payment options. These issues slow growth, create legal risks, and make global hiring a pain in the neck!

Fractional CFOs working with distributed teams report consistent pain points: contractor misclassification penalties, complex tax requirements across different countries, and the inability to offer crypto payment options that top talent demands.

Rise’s Complete Global Hiring Payroll Infrastructure

Rise addresses these challenges through four main services designed for global operations:

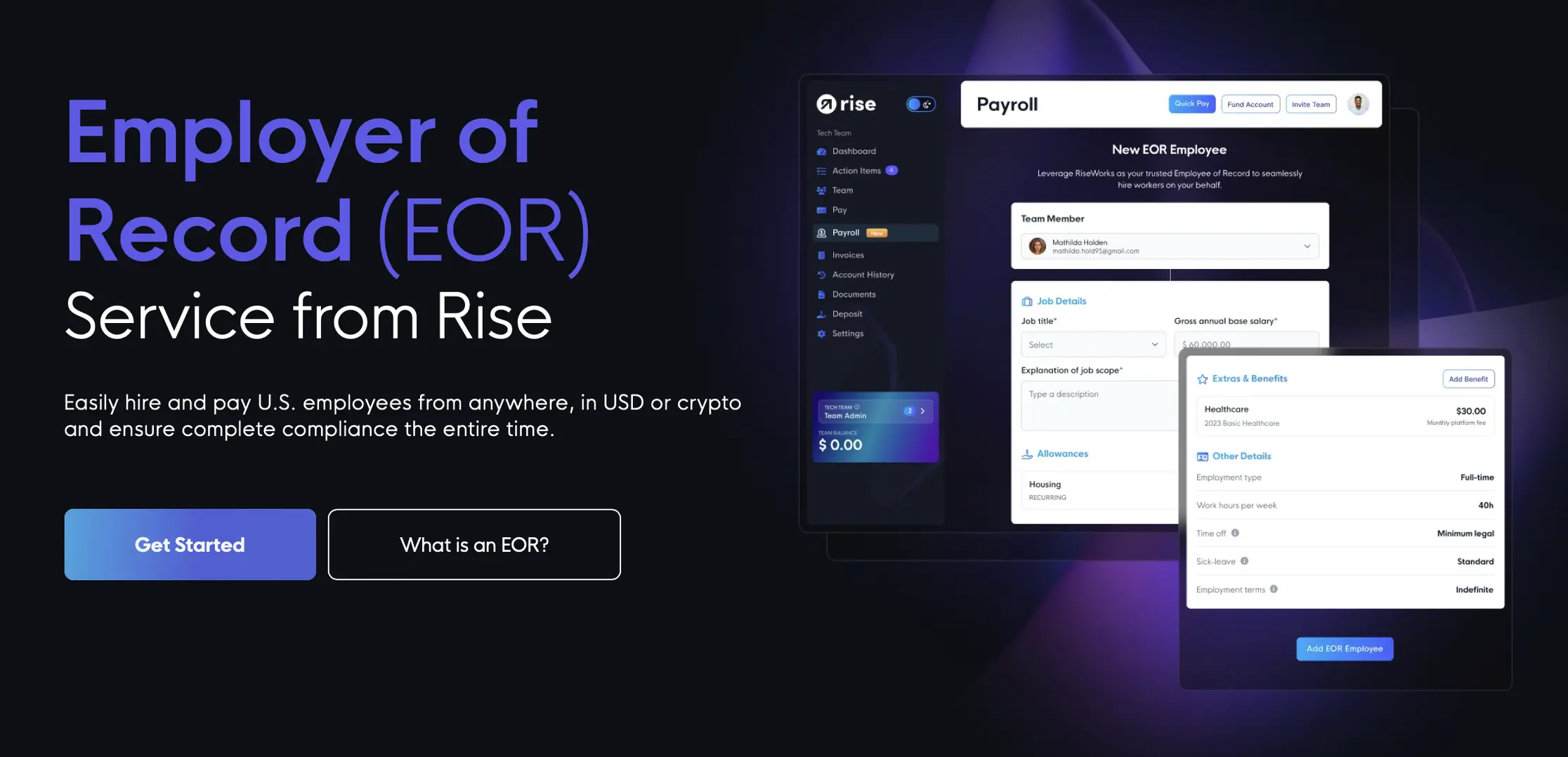

Employer of Record (EOR) Services

Rise’s EOR service stands out as their flagship offering for companies needing full-time international employees without establishing local entities. Instead of setting up expensive overseas offices, businesses hire employees directly through Rise-owned entities that handle all legal responsibilities.

The EOR service currently operates in the United States, United Kingdom, and Canada, with expansion to over 60 countries planned by the end of 2025. Rise manages complete employment responsibilities including compliance, payroll administration, and benefits packages. The automated onboarding system streamlines the hiring process while ensuring compliant employment agreements that protect against misclassification penalties.

Employees receive competitive benefits packages featuring generous healthcare options and crypto-friendly 401(k) plans unavailable through traditional providers. This combination appeals particularly to web3 talent who value both comprehensive benefits and cryptocurrency integration.

The hybrid payroll system offers maximum flexibility, allowing companies to pay employees in local currencies, stablecoins, or cryptocurrencies based on preference and operational needs. Rise handles all local labor laws, tax obligations, and required filings across different jurisdictions.

Companies using Rise’s EOR service report significant cost savings compared to establishing local entities. The service starts at $399 per employee monthly and includes complete tax compliance, local employment law adherence, and comprehensive benefits management. For web3 companies building global teams quickly, this removes major barriers to global hiring while ensuring full legal protection.

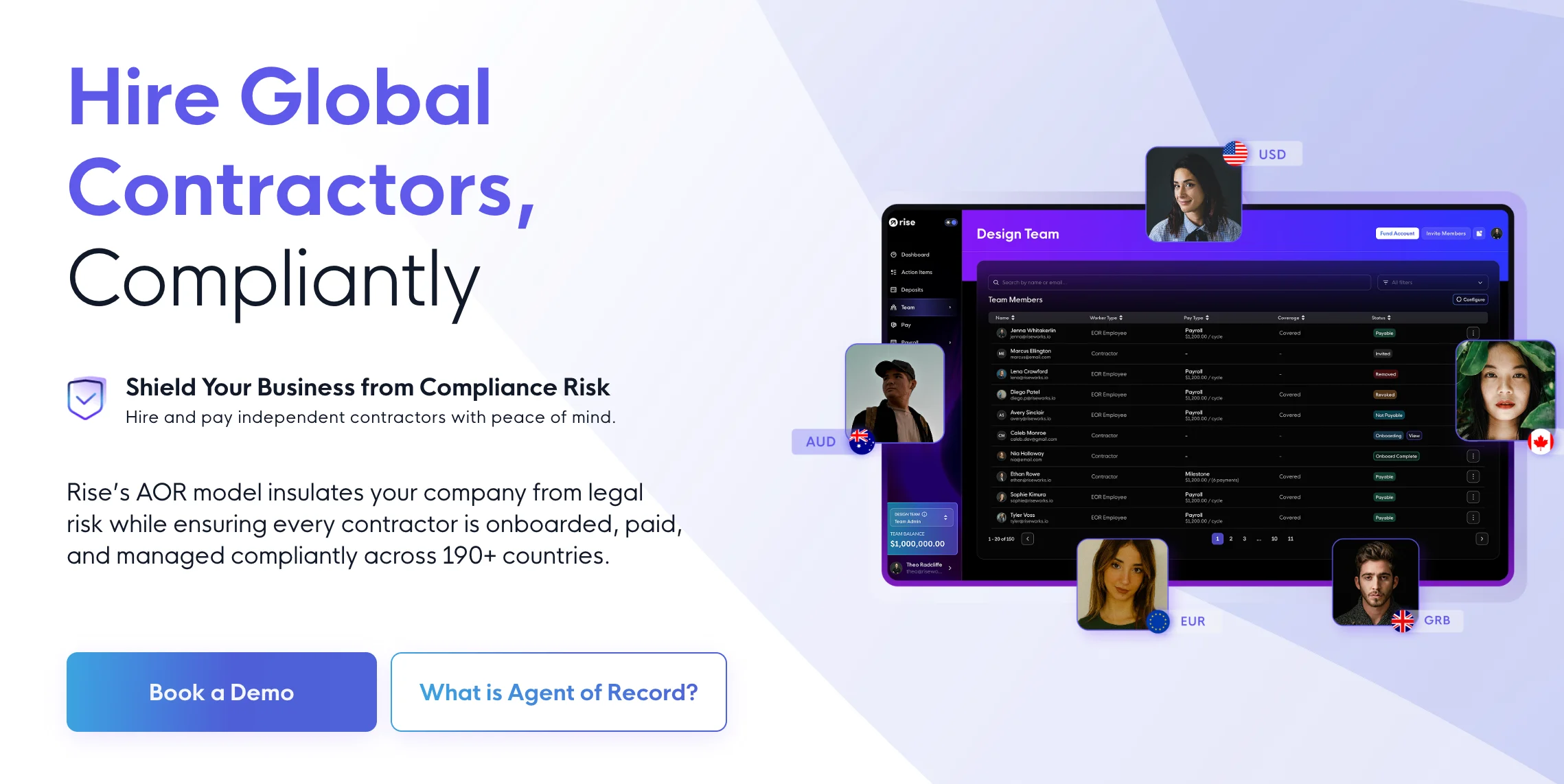

Agent of Record (AOR) for Contractors

The AOR service protects companies from contractor misclassification penalties by serving as the legal intermediary. Contractors sign agreements directly with Rise, creating legal separation between the company and potential liability issues.

This service proves particularly valuable for web3 companies working with developers and contractors globally. Rise handles onboarding across 190+ countries, manages compliant agreements, performs classification checks, and generates required tax forms. The service costs $400 per contractor monthly and includes ongoing compliance monitoring.

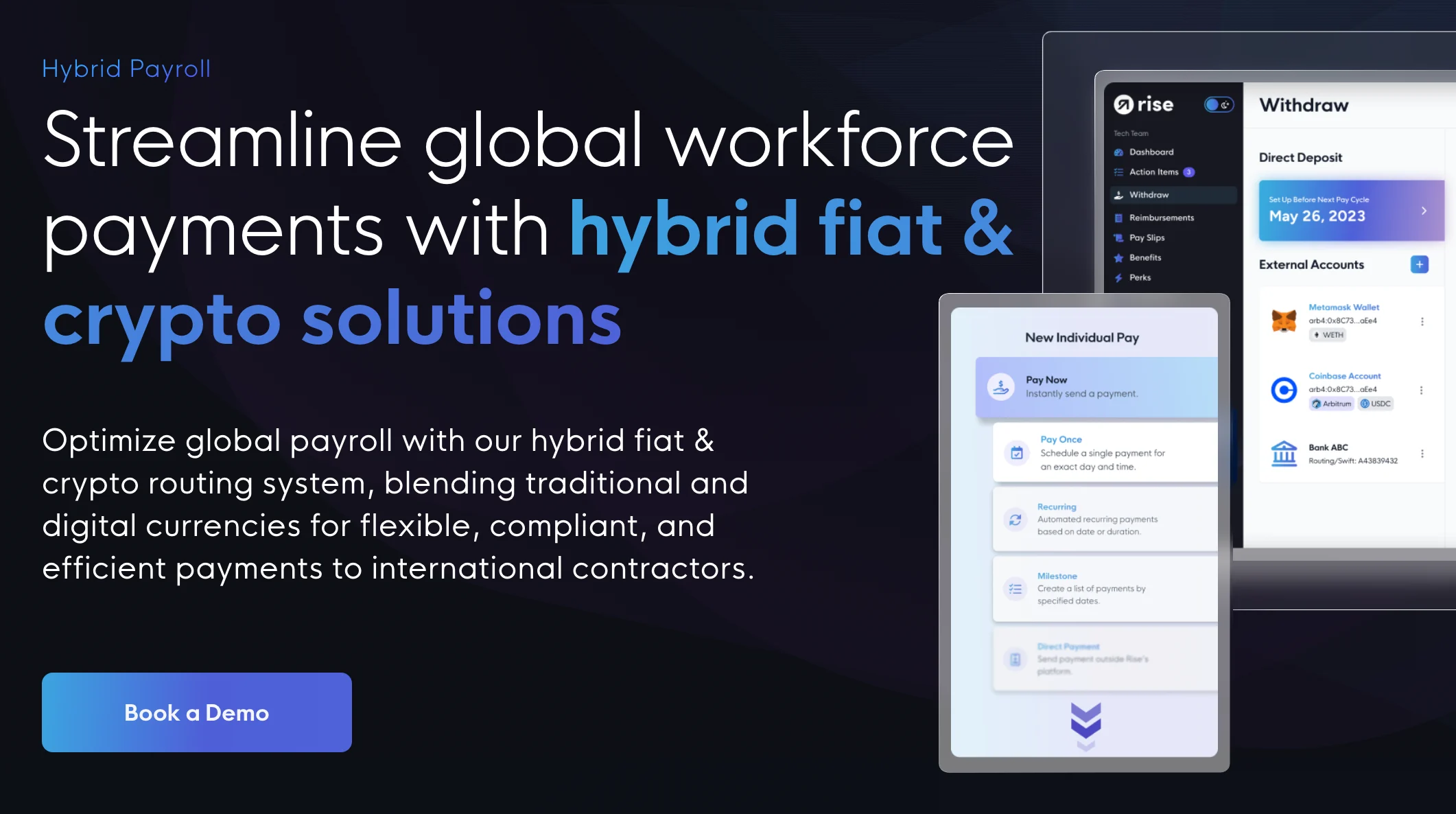

Global Contractor Payments

Rise simplifies international contractor payments through flexible funding and payout options. Companies can fund payroll using USD, USDC, or USDT, then automate recurring payments to contractors worldwide.

Contractors receive instant payouts in over 90 fiat currencies and 100+ cryptocurrencies. The system includes automated tax reporting and smart contract automation for milestone-based payments. Pricing offers flexibility with either $50 per contractor monthly or three percent of payment volume.

Direct Global Hiring Payroll for US Teams

For US-based operations, Rise provides comprehensive payroll services supporting traditional and crypto payments. Teams can receive payments in USD, stablecoins, or cryptocurrencies on flexible schedules.

The service includes access to benefits marketplaces and healthcare options, plus easy withdrawal capabilities in both fiat and crypto formats. This appeals to web3 companies wanting to offer cutting-edge payment options to domestic employees.

Why Web3 Companies Choose Rise

Crypto-Native Payment Infrastructure

Unlike traditional payroll providers that treat crypto as an afterthought, Rise built their system around multi-currency operations from the ground up. Companies can maintain treasury operations in stablecoins while paying employees and contractors in their preferred currencies.

This approach eliminates banking complications common with crypto businesses. Instead of complex wire transfers and currency conversions, companies can fund payroll directly with USDC or USDT and let recipients choose their payout method.

Compliance Without Complexity

Rise handles regulatory requirements across 190+ countries, removing the burden of tracking different jurisdictions’ employment laws. The platform automatically generates required tax forms, monitors compliance status, and updates procedures as regulations change.

For web3 companies focused on product development rather than HR administration, this automation proves essential. Teams can concentrate on building while Rise manages the operational complexity of global employment.

Speed and Flexibility

The platform enables contractor onboarding within minutes rather than weeks. New team members can start contributing immediately while Rise handles paperwork in the background. This speed advantage helps web3 companies compete for top talent in competitive markets.

Payment flexibility also attracts high-quality contractors who prefer crypto compensation. Rise supports over 100 cryptocurrencies for payouts, giving teams more options than traditional payroll systems.

Real-World Global Hiring Results

Companies using Rise report significant operational improvements. Jeremy Anderson noted that Rise eliminates traditional banking headaches by accepting USDC deposits directly, while Daniel Keller praised the platform’s blockchain technology integration and streamlined setup process.

Team satisfaction increases when employees gain flexible payment options. One company reported higher employee retention after implementing Rise’s crypto payout capabilities, with team members appreciating the ability to receive monthly payments through various cryptocurrency wallets.

Cost Structure and Transparency

Rise maintains transparent pricing without hidden fees. The EOR service starts at $399 per employee monthly, AOR protection costs $400 per contractor monthly, and global contractor payments use either flat $50 monthly fees or three percent of volume.

This predictable cost structure helps CFOs budget accurately for global expansion. Startup-friendly discount programs make the platform accessible for early-stage companies building their first international teams.

Implementation Considerations

Companies switching to Rise benefit from comprehensive onboarding support and real-time reporting capabilities. The platform provides detailed analytics for payroll activities across all jurisdictions, giving financial leaders visibility into global operations.

The system integrates with existing accounting software and provides audit trails for compliance purposes. This integration capability reduces the technical overhead of adopting new payroll infrastructure.

The Future of Global Hiring

As more companies build distributed teams, payroll solutions must handle increasing complexity around currencies, jurisdictions, and payment preferences. Rise’s approach of supporting both traditional and crypto payments positions it well for the evolving workspace.

Web3 companies particularly benefit from this flexibility, as their teams often prefer crypto compensation and span multiple countries. Traditional payroll providers struggle with these requirements, making specialized solutions like Rise increasingly valuable.

For web3 businesses ready to scale their global operations without the complexity of traditional employment infrastructure, Rise provides the comprehensive tools needed to compete for top talent worldwide while maintaining compliance across all jurisdictions.

_________________________________________________________________

Want to know how to increase customers and sales for your business?

Tap here to chat to me and I’ll show you how we make it happen.

If you’ve enjoyed reading today’s blog, please share our blog link below.

Do you have a blog on business and marketing that you’d like to share on influxjuice.com/blog? Contact me at rob@influxjuice.com.

Want to know how we can guarantee a mighty boost to your traffic, rank, reputation and authority in you niche?

Click here to access our Playbook – ‘SEM/GEM Guide’.