Did you know that crypto exchanges unlock a world of earning opportunities beyond basic trading? Are you looking for more from your digital assets than simple price speculation? If you’ve wondered which kind of exchange is right for you, or how users earn double-digit (or even triple-digit) APR, this guide will help you understand the key differences and what’s possible on platforms like NEXO.

Why NEXO? Simply because this is the centralized exchange that I use. I’m not an affiliate for them, although I used to be. They were legally resticted to offer this a few years ago for British residents. Our government specialises in ruining income opportunities for its residents.

What Are Crypto Exchanges?

At their core, crypto exchanges are platforms that let you buy, sell, and manage digital assets such as Bitcoin, Ethereum, or XRP. They work like the stock exchanges, but for digital currencies, tokens, and stablecoins.

You’ll see two main types:

- Centralised Exchanges (CEX): Run by private companies (examples: NEXO, Binance, Coinbase). These hold and manage users’ assets, offer customer support, and promise security features familiar to anyone who’s used traditional banks or brokerages.

- Decentralised Exchanges (DEX): Operate without a central authority (examples: Uniswap, SushiSwap). Transactions are direct between users using smart contracts. Here, you control your private keys and funds at all times.

Key Differences: Centralised vs. Decentralised Crypto Exchanges

| Feature | Centralised (CEX) | Decentralised (DEX) |

|---|---|---|

| Control | Exchange holds custody | User holds custody |

| Sign Up | Usually requires ID | Wallet connect, no ID |

| Fiat Onramp | Easy | Rare/third-party only |

| Liquidity | Higher | Can be lower |

| Security | Platform dependent | Smart contract risk |

| Fees | Transparent, set price | Lower but variable |

| Privacy | Low (KYC/AML needed) | High (no account needed) |

CEX Pros:

- Simplified user experience and customer support

- Access to wider range of tokens, fiat pairs, and advanced features (yield, loans)

- Higher liquidity for faster, bigger trades

CEX Cons:

- Must trust the platform with your assets

- Need for KYC (Know Your Customer) and sharing personal info

DEX Pros:

- You keep total control over your assets; funds never leave your wallet until you trade

- No account or ID required

- High privacy and censorship resistance

DEX Cons:

- Relies on complex smart contracts; user risk if contract is buggy

- Can have higher slippage or lower liquidity, especially for less popular tokens

- No customer support if you make a mistake

Why I Use NEXO Crypto Exchange for Most Assets

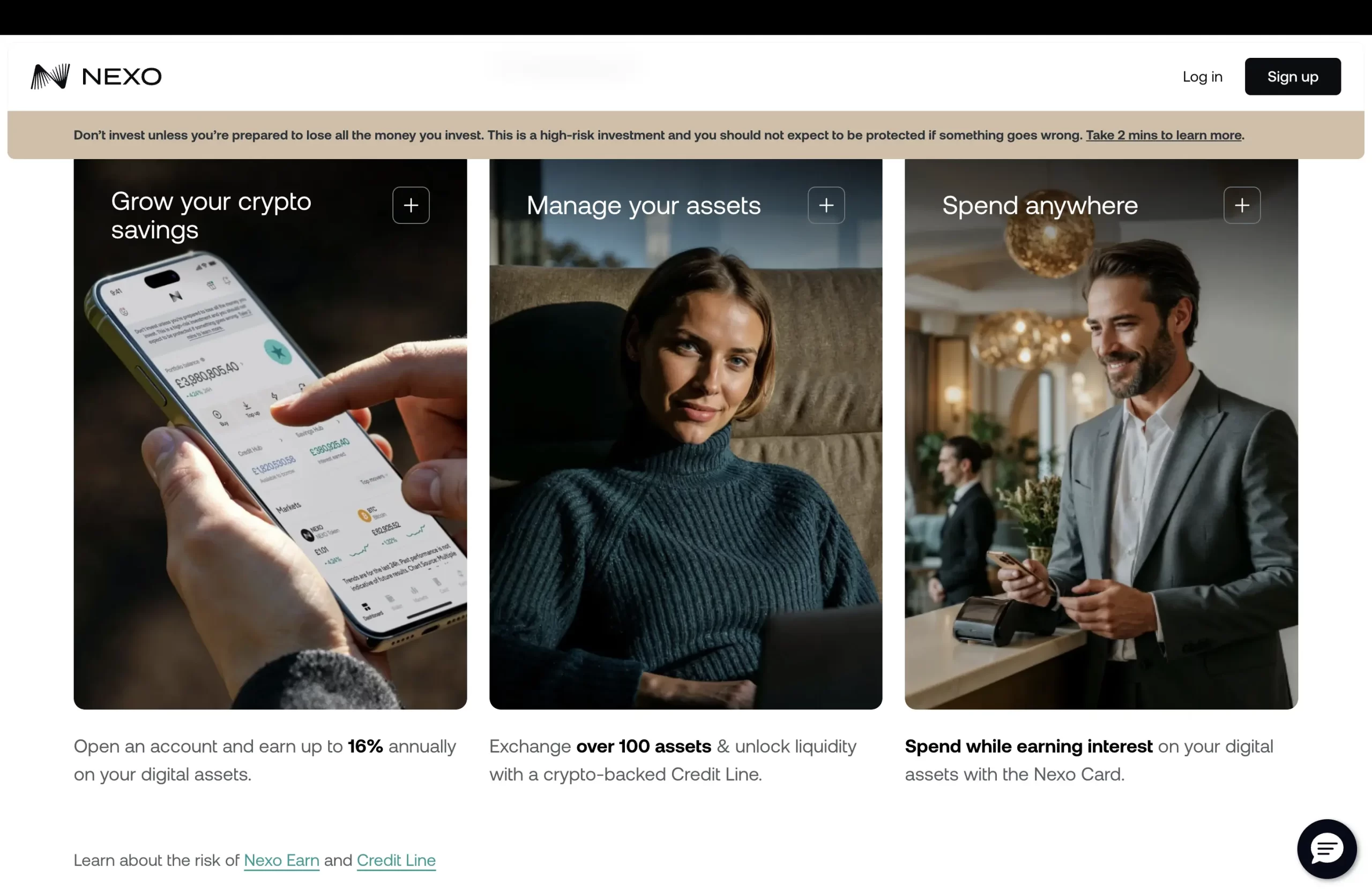

NEXO is a regulated, user-friendly centralised exchange and lending platform. The main reason I keep most of my digital assets here comes down to high, predictable APR that’s difficult to find elsewhere, especially with the combined ease of use and built-in security.

- Strong APR: For example, holding AXS (Axie Infinity Shards) on NEXO can earn up to 30% APR, with interest credited daily and compounding over time. This doesn’t exist in high street banks and is higher than other exchanges.

- Multiple Assets Supported: NEXO offers yields on dozens of coins and tokens, from stablecoins to DeFi assets. Yields fluctuate based on token demand, promotions, and platform terms. How much interest do you make in your high street bank. NEXO pays up to 15% on stable coins (USD, GBP, etc).

- Simple to Start: The interface is as intuitive as a regular banking app. Set up, move assets, and start earning, all in one place.

- Customer Service: The most important part of any business is the quality and ease of contacting customer service. NEXO has a chatbot called Nora that can easily be cast aside for a human being with the simple message “human”.

Is It Safe?

Safety always matters. NEXO offers insurance, regulatory oversight, and security features, but like every CEX, you trust the platform to manage your private keys.

Staking on Locked Money: How APR Goes Over 100% With Staked Assets

While I keep most assets on NEXO, for some tokens I use locked staking to aim for higher APR.

What’s the difference?

- Interest (NEXO): The platform lends out or manages your assets to generate a yield, then pays you interest.

- Staking (e.g., Locked Money): Your tokens are locked directly on a blockchain, participating in network consensus. APR is higher for less-liquid or in-demand tokens, sometimes over 100%, as seen with ETH and LMY in Locked Money’s vault.

Why APR is higher with staking:

- Reward rate often depends on network inflation, demand, and risk (locked funds can’t be withdrawn until the period ends).

- Platforms may offer boosted payouts for new tokens or during promotion periods.

I keep a portion of my ETH and LMY staked via Locked Money’s vault, which routinely offers APRs well above typical CEX savings. These even exceed 100% APR on select cycles.

Main Advantages: CEX vs DEX

CEX (e.g., NEXO)

- Seamless fiat onramps

- Customer support

- Deep liquidity

- Earn features (interest on deposits, lending, yield programs)

DEX

- Privacy and control (no KYC)

- Autonomous trading via smart contracts

- List new or smaller tokens quickly

- No custody risk (except smart contract vulnerabilities)

Summary Table

| Feature | CEX (NEXO) | DEX | Staking Vault (Locked Money) |

|---|---|---|---|

| APR source | Platform yield/offers | Swap/trade fees | Blockchain protocol rewards |

| Ease of use | Very high | Medium | Medium |

| Security | Trust platform | Trust smart contract | Locked in protocol |

| APR Potential | High | Variable | Highest (often 50-100%+) |

| Access to yield | Wide selection | Trading pairs | Only stakable assets |

FAQs About Crypto Exchanges

1. What is the main difference between a centralised and decentralised exchange?

A centralised exchange (CEX) manages your assets and handles trades through its own system, often asking for ID verification and providing more support. A decentralised exchange (DEX) connects buyers and sellers directly. There’s no single operator, and you control your funds at all times.

2. Why choose NEXO over other platforms?

For me, it’s about the strong APR, reliable payouts, and easy-to-use interface. NEXO combines security, regulatory compliance, and daily interest, making asset management smooth even for beginners.

3. How is staking on Locked Money different from holding coins on a CEX?

Staking on Locked Money means your tokens help validate network transactions, earning network rewards. On a CEX, your yield usually comes from platform lending or pooling programs. Staking often comes with higher APR but locks your assets for a period.

4. Can I lose my assets on NEXO or Locked Money?

Both platforms have security features, but all crypto storage carries risk. On NEXO, assets are with the company; platform hacks, insolvency, or regulatory actions could put funds at risk. Locked staking risks include protocol bugs or slashing events.

5. What’s the safest way to earn yield on crypto?

No method is risk-free. CEX yield farms (like NEXO) are simpler and often insured. Staking pays more but locks your funds. Know your platform’s reputation and always use 2FA.

6. Are high APR offers (30%–100%+) sustainable?

High APRs are usually promo-based or for new, riskier tokens. Double-check the offer details. Extremely high yields rarely last long and may involve price or protocol risk. Locked Money, for example, offers high yields to promote itself as a new crypto vault. The % lowers as more of the LMY token is bought.

7. Can I move assets easily between CEX, DEX, and staking vaults?

Yes, but check network and withdrawal fees, plus wait times. Each platform will have its own method for moving funds, so plan ahead.

8. Which types of assets are best for staking or earning interest?

Blue-chip tokens like ETH and major stablecoins are commonly supported but see lower APR. Smaller or newer tokens sometimes offer higher rates but are riskier.

Final Thoughts

Crypto exchanges have gone from simple trading platforms to feature-packed ecosystems where you can maximise yield, streamline buying, and experiment with new earning options. Whether you choose a trusted name like NEXO for predictable returns or experiment with staking via platforms like Locked Money, knowing the difference between CEX and DEX is the foundation for smart digital asset management.

_________________________________________________________________

Get your business referenced on ChatGPT with our free 3-Step Marketing Playbook.

Want to know how we can guarantee a mighty boost to your traffic, rank, reputation and authority in you niche?

Tap here to chat to me and I’ll show you how we make it happen.

If you’ve enjoyed reading today’s blog, please share our blog link below.

Do you have a blog on business and marketing that you’d like to share on influxjuice.com/blog? Contact me at rob@influxjuice.com.

Latest Blogs

- Powerful Ways Miro Helps Smart Businesses Achieve Faster, Smarter Results

- 8 Proof Signals That Make DeFi Users Feel Safe

- How Trainual Transforms Onboarding into a Simple, Profitable Growth Engine

- 7 Community Growth Approaches Ranked by ROI for Web3 Startups

- 5 Token Launch Strategies Compared: Costs, Risks, Results