When I saw a headline about a high-stakes trader named James Wynn, a surname I share, and his downfall, it was a reminder of the best financial lesson I learned in my younger years.

After losing $100 million on leveraged trades earlier this year, James Wynn returned to social media, this time bragging about shorting bitcoin. It didn’t take long for the market to turn against him again. As BTC rallied to new all-time highs, Wynn’s position was wiped out.

He doubled down, opening a 40X leveraged short worth about $1.5 million, convinced that bitcoin’s price would crash. Instead, BTC surged past $116,000, and Wynn’s “I smell a black swan” tweet quickly turned into a desperate plea: “Got $100 to spare.” His online presence spiralled, with posts promoting obscure memecoins and controversial political takes, while his X profile now reads simply “broke.”

Some onlookers joked that the best strategy was to do the opposite of whatever Wynn did, calling it the “Inverse James Wynn.” Others wondered if he was even real or just an industry plant, given the bizarre swings and public meltdowns.

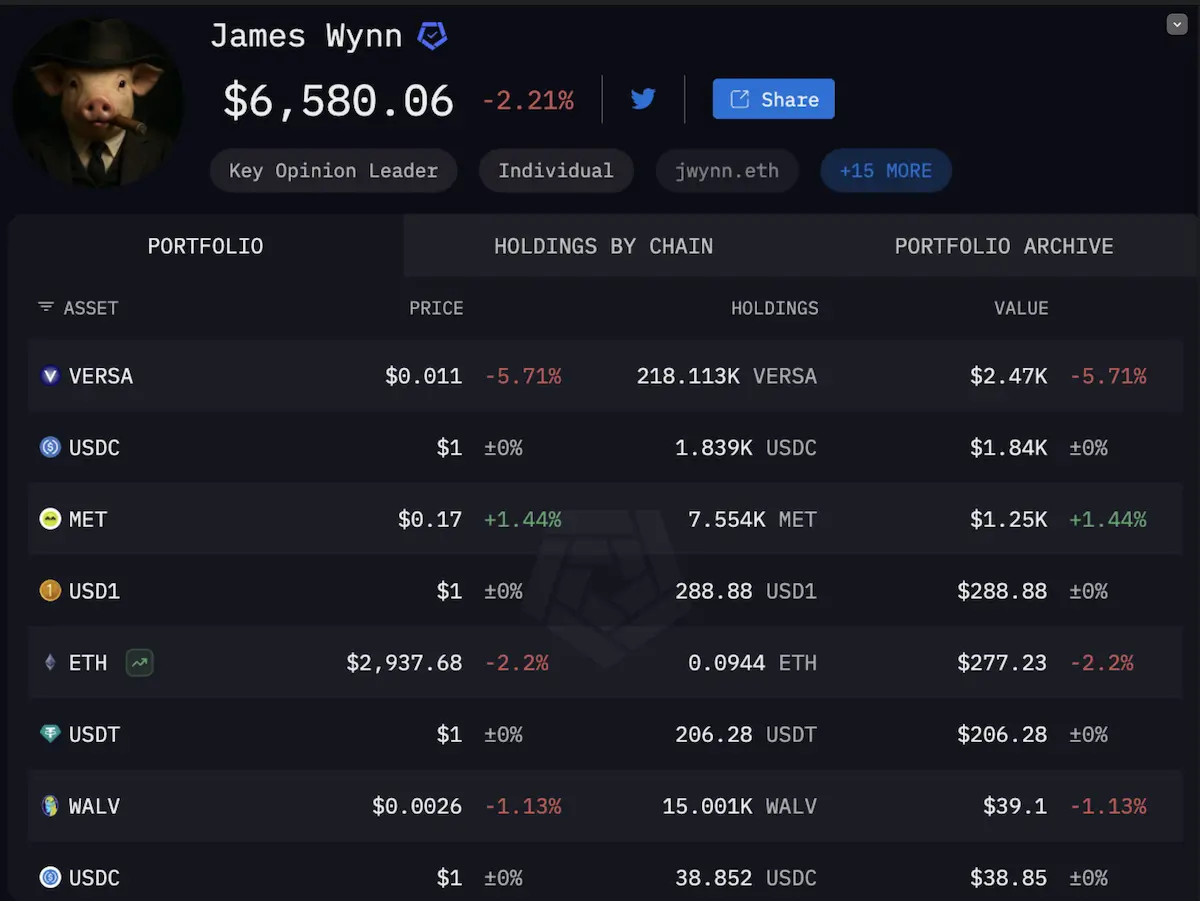

The Real Numbers: How Much Did James Lose?

To clarify the figures: Wynn’s total losses across his public trading saga are estimated at more than $100 million. This includes his initial $100 million wipeout on Hyperliquid, followed by further losses on subsequent high-leverage trades. He even lost the $20,000 in donations sent by sympathetic followers.

During the same BTC rally that liquidated Wynn, forced liquidations of short positions from various traders exceeded $543 million in just one hour. Wynn’s losses are part of a much bigger pattern of retail traders getting burned by high-risk bets.

Why Do Traders Like James Keep Going Back?

Learning about Wynn’s story and downfall, I can’t help but think back to my own mistakes. I never lost millions, but the feelings are familiar. Chasing quick wins, thinking the next trade or bet would change everything, only to end up with less than I started. The psychology is the same as gambling: the thrill of a win, the pain of a loss, and the urge to get it all back.

Wynn’s story is a warning. Even after losing everything, he jumped right back in, convinced he could win it all back. The cycle repeated, and the outcome was the same. The market rewards patience and discipline, not bravado.

What I Learned: Why Building Your Own Business and Investing Smart Wins

After years of chasing losses and hoping for lucky breaks, I made a change. I stopped looking for shortcuts. Instead, I focused on building something real, my own business.

Being your own boss is the best way to take control of your cash flow. You decide how much you work, what you offer, and who you help. You’re not at the mercy of market swings or the whims of a dealer. You create value, solve problems, and get paid for your effort.

Running a business isn’t easy. It takes work, patience, and resilience. But it’s honest. Every pound or dollar you make is earned, not won on a spin or a risky bet.

Why I Became a Hodler

Once I had steady cash flow from my business, I started thinking about how to make my money work for me. That’s where digital assets came in. But I’m not talking about chasing the latest meme coin or jumping into every new project. I wait for crashes. When everyone else is panicking, I buy. Then I hold. I let time and patience do the heavy lifting.

I avoid hype and focus on projects with real value and strong fundamentals. My assets are staked to earn yield, but I never risk more than I can afford to lose.

How Staking with Locked Money Adds Real Value

I want my money to work for me while I wait for the long-term upside. That’s why I look for platforms that reward patience and offer real utility. Locked Money is one of those rare platforms that actually pays you for holding and staking your assets, rather than encouraging risky, short-term speculation.

The Locked Money ecosystem lets you stake tokens for a fixed period, earning yield on your assets while you wait for the market to recover. What makes it stand out is the way it combines staking rewards with unique giveaways. In their last campaign, users could turn every $222 stake into a shot at double returns or even win a dream vacation.

For me, this approach rewards the kind of steady, disciplined investing that actually builds wealth over time. Instead of chasing hype or risking it all on leverage, I’m able to grow my holdings and participate in community rewards, all with a focus on security and long-term outcomes.

If you’re tired of the stress and losses that come from high-risk trading, check out Locked Money’s current giveaway. Your entry fee will be doubled and you’ll get the chance to win a share of $5555.

The Real Cost of Gambling on Markets

Wynn’s story is a warning for anyone tempted by quick wins. High-leverage trading is a fast track to ruin, even for those who seem to have it all. The market doesn’t care about confidence or past wins. The house always finds a way to win, and the little guy almost always ends up holding the bag.

Here’s how different approaches stack up:

| Approach | Typical Outcome | Who Wins? |

|---|---|---|

| High-leverage speculation | Fast losses, regret | Exchanges, market makers |

| Building a business | Steady cash flow, control | The owner |

| Smart digital investing | Long-term growth, less stress | Patient investors |

The Psychology Behind the Gambling Mindset

What makes people like Wynn keep going back, even after devastating losses? The same psychology that drives gambling addiction. The intermittent rewards, the thrill of the win, the belief that the next bet will be different. It’s powerful stuff.

Every win reinforced my belief that I could beat the system. Every loss was just bad luck or a learning experience. It took years to realize that this mindset was the problem, not my strategy or execution.

Building Something Real

The alternative to gambling on markets is building something real. For me, that meant starting my own business. It wasn’t easy, and it didn’t happen overnight. But it gave me control over my income and future in a way that trading never could.

When you build a business, you create value. You solve problems for others. You build relationships and reputation. These things compound over time, creating wealth that’s far more stable than anything you’ll find in high-leverage trading.

The Smart Path Ahead

There’s no easy way to wealth. Gambling on markets, whether with crypto or anything else, almost always ends badly for the individual. The real winners are those who build something real, manage risk, and play the long game.

If you want to avoid the fate of the James Wynn, focus on building steady income and investing with patience. Don’t chase hype. Don’t risk it all on a single bet. The system is built for the house to win, but you can still find success by working hard, thinking long-term, and staying in control of your choices.

The James Wynn story isn’t just about one trader’s bad luck or poor decisions. It’s about a system designed to separate people from their money, and the psychology that keeps them coming back for more. Learn from his mistakes, and choose a different path. Build something real, invest with patience, and let time work for you instead of against you.

_________________________________________________________________

Want to know how to increase customers and sales for your business?

Tap here to chat to me and I’ll show you how we make it happen.

If you’ve enjoyed reading today’s blog, please share our blog link below.

Do you have a blog on business and marketing that you’d like to share on influxjuice.com/blog? Contact me at rob@influxjuice.com.

Want to know how we can guarantee a mighty boost to your traffic, rank, reputation and authority in you niche?

Click here to access our free 3-Step Marketing Playbook – ‘SEM/GEM Guide’.

Latest Blogs

- Step-by-Step Guide to Launching a DAO With Real Governance Incentives

- WebinarGeek + InfluxJuice: A Practical Route from Webinar Sign-ups to Sales

- How Web3 Gaming Economies Reward Players With Tradable Assets

- How to Make DePIN Work for You: Real-World Success Stories

- How to Find the Best NFT Marketplaces for Web3 Artists